The Green Mission Inc. has strengthened its deconstruction appraisal protocol, responding to recent tax-deduction cases by enhancing IRS- and USPAP-compliant documentation, valuation support, and more rigorous standards for developing preliminary estimated value ranges.

The latest climate report from the Intergovernmental Panel on Climate Change (IPCC), states that “Global warming is dangerously close to spiraling out of control” and humans are “unequivocally” to blame.

After decades in federal tax policy and years in deconstruction, I’ve learned the vast tax code holds powerful solutions. Today, those tools are urgently needed to address critical challenges we all face.

The three parties to an appraisal MUST remain independent to ensure accuracy and validity of the deconstruction tax donation. We recently experienced an issue where these lines were blurred, and the taxpayer could have found themselves without a compliant appraisal.

The US Tax Court has delivered yet another loss of a non-cash charitable contribution, this time due to a technicality. In the latest case, Albrecht v. Commissioner, TC Memo 2022-531, a well-meaning donor lost the value of her entire charitable deduction for property donated to a museum due to a technicality in the written receipt provided by the museum.

On November 7th, 2024, the Appraisers Association of America (AAA) hosted an enlightening panel featuring Susan Hunter (moderator), Karin Gross (IRS Counsel), and Meredith Meuwley, AAS (Art Advisory Services). The panel discussed critical updates and best practices for appraisers preparing reports for gift, estate, and non-cash charitable contributions, highlighting the importance of professionalism, due diligence, and adherence to IRS guidelines. Below is a detailed summary and analysis of the discussion, crafted for CPAs, personal property appraisers, and most importantly, the taxpayer.

It appears to be typical of any IRS codification or procedural direction, that the end result must be confusion. Obtaining clarification may involve hours of wait-time to speak to a real person or a head-first dive down the rabbit hole of reading scholarly articles on a CPA or tax attorney’s interpretation of said codification. When it comes to appraisers, they may inadvertently interpret IRS publications incorrectly and expose the client to risk for an audit and the subsequent loss of their non-monetary charitable contribution deduction due to failure to procure proper documentation.

The concept of “Related Use” continues to present an area of confusion, especially for nonprofits and relates directly to Tax Form 8282. Related-use is the stipulation that a nonprofit must utilize donations to further their defined mission.

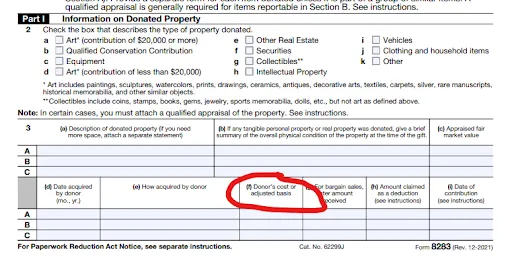

For non-cash charitable contributions exceeding $5,000, the IRS requires completion of Form 8283 Section B by the taxpayer and certification by a qualified appraiser. Box F of this section specifically requires the donor to provide the original cost or adjusted basis of the donated property. This entry allows the IRS to evaluate whether the claimed charitable deduction is reasonable in comparison to the donor’s original investment.

This past weekend, our team completed comprehensive inspections of five promising deconstruction projects across New York City, spanning Queens, Manhattan, and the Bronx. These site visits represent a significant expansion of our sustainable building material recovery services into one of the nation’s most architecturally rich markets.