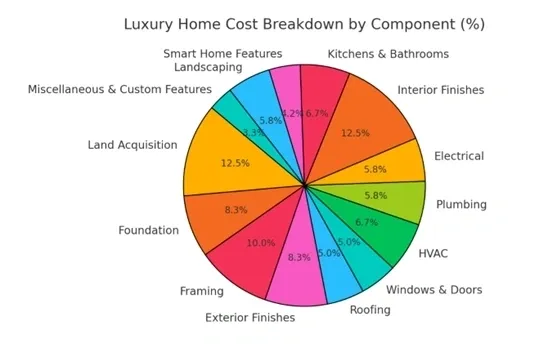

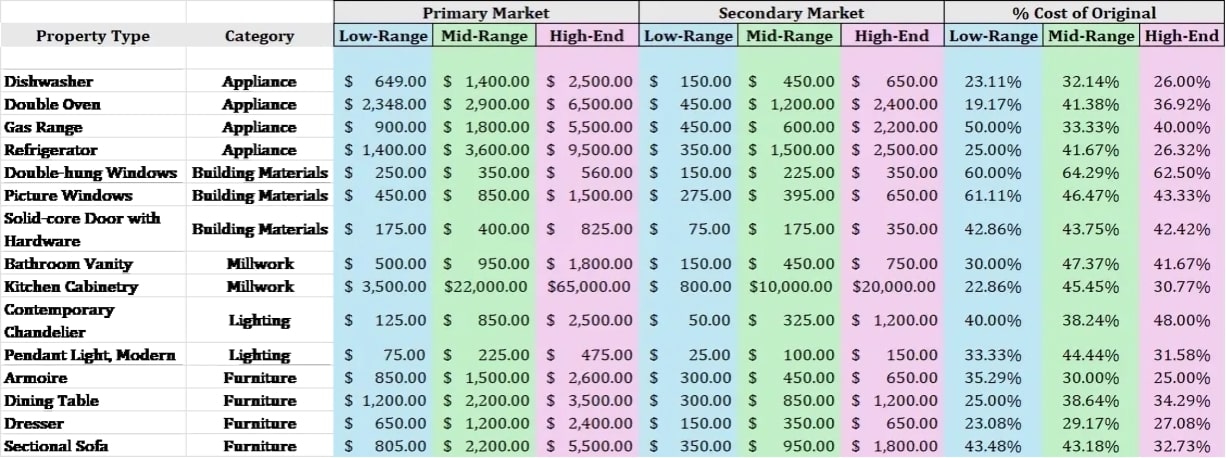

The valuation of materials and fixtures within real estate depends heavily on their attachment to the property versus their status as detached personal property. This principle is crucial in real estate appraisals, taxation, insurance, and donation valuations, particularly in the context of deconstruction and salvage. When components remain attached as part of an improvement, they typically carry higher value due to their contribution to the real estate’s utility, marketability, and financing potential. However, once removed, their value often declines due to depreciation, secondary market limitations, and diminished functionality in a different setting.

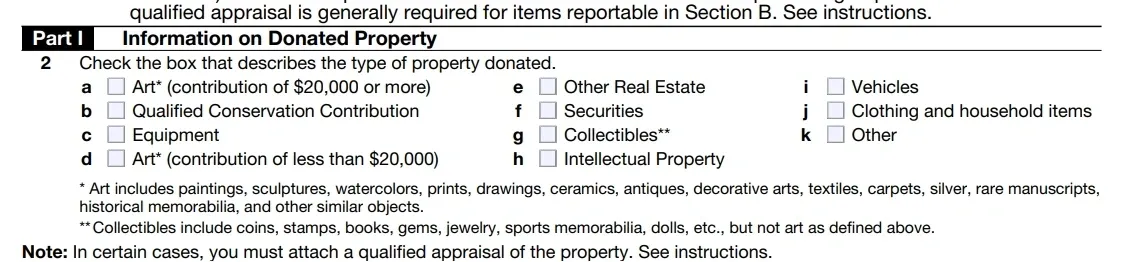

The Internal Revenue Code (IRC) Section 170 provides valuable tax incentives for C Corporations to donate inventory to qualified charitable organizations. Specifically, Section 170(e)(3) allows an enhanced charitable deduction for inventory donations, a provision designed to encourage businesses to contribute surplus goods to nonprofits rather than discarding them or selling them at a loss. Below, we explore the details of this provision, including how the deduction is calculated, substantiation requirements, and when an appraisal is necessary.

Non-cash charitable contributions, particularly those exceeding $5,000, have become a focal point for IRS enforcement and Tax Court rulings. While charitable giving provides an opportunity to benefit both the donor and the receiving organization, it also requires fastidious compliance with documentation requirements to withstand the heightened scrutiny of tax authorities. This article outlines key Tax Court cases, IRS substantiation rules, and proactive strategies for ensuring non-cash charitable contributions meet all necessary requirement.

Two decades after the inception of the “deconstruction” movement, the secondary market for reused building materials remains underwhelming in both demand and value. Despite tens of millions of dollars awarded to individuals and organizations for regional assessments, feasibility studies, model programs, and attempts to create uniform sales practices, the fundamental issues persist:

The Green Mission Inc. is thrilled to announce the formation of its Youth Coalition for Sustainable Deconstruction, an innovative initiative dedicated to gathering and amplifying the voices of young people with a passion for sustainable building practices. This coalition will serve as a vibrant platform for university students, trade students, emerging professionals, and anyone with a vested interest in the deconstruction industry. The Youth Coalition is designed to empower and inspire the next generation to engage with sustainable deconstruction practices and make meaningful contributions to a more circular economy.

The Green Mission Inc. has spent the past five years deeply involved in examining and reporting on the valuation metrics of the secondary market for building materials. As industry leaders in deconstruction valuations and sustainability practices, we have seen firsthand the significant untapped potential within this market. Through our work, we have identified strategies to maximize the value of salvaged materials while promoting sustainability. This article delves into how transforming the secondary market can create a more efficient, value-driven supply chain that benefits consumers, businesses, and the environment, unlocking new opportunities for growth and innovation.

In recent years, deconstruction has emerged as a powerful force driving sustainability in the construction and renovation industry. By prioritizing the careful disassembly and salvage of materials, deconstruction not only reduces waste but also contributes to the reuse and recycling industry. Crucially, one of the key drivers behind the increasing adoption of deconstruction by homeowners is the availability of financial incentives, particularly in the form of tax benefits. Here, we delve into how these tax benefits are helping propel the reuse and recycle industry forward while providing homeowners with compelling reasons to choose deconstruction over traditional demolition.

Are you a commercial property owner facing the daunting task of orchestrating a corporate clean-out or remodel? Are there perfectly reusable furnishings, appliances, desks, computers, cubicles, or cabinetry slated to be discarded now or in the future? Would you be open to learning the benefits of waste diversion and contributing to make this world a safer, greener place for generations to come? Would you also potentially like to save money in the process and feel good about your business choices?

Our CEO Jessica I. Marschall, CPA, ISA AM recently attended the Appraisers Association of America annual conference in Manhattan.

IRS Counsel and presenters included Karin Gross, Meredith Meuwly, and Cynthia Herbert and provided critical feedback on the appraisal process.

The market for buying used building materials can vary depending on your location, but there are several common options to consider: