The Green Mission Inc. has strengthened its deconstruction appraisal protocol, responding to recent tax-deduction cases by enhancing IRS- and USPAP-compliant documentation, valuation support, and more rigorous standards for developing preliminary estimated value ranges.

The IRS has recently announced that they will be concentrating staffing efforts towards High Net Worth (HNW) and pass-through entities. Individuals usually taking non-cash charitable donations are often HNW. It is critical that our clients and their CPAs and tax advisors understand the risks and the requirements for an IRS Qualified Appraisal produced by an IRS Qualified Appraiser.

Historic preservation and deconstruction go hand-in-hand. Our CEO Jessica I. Marschall, CPA, ISA AM, recently joined the Minnesota-based Rethos Board of Directors. With her background in tax and deconstruction tax deductions, she hopes to assist in educating others about the distinctions between historic preservation versus deconstruction and encouraging the responsible and thoughtful approach to handling historic structures and materials.

After the passing of a loved one, local, state, or federal courts often request an appraisal of the decedent’s property. The inheritors and executors often face a long list of required forms and filings, which can become overwhelming. First, ensure the estate is being handled by a good attorney and CPA. Our team provides services including inventory and documentation of appraisal property and appraisal services, if required.

After the passing of a loved one, local, state, or federal courts often request an appraisal of the decedent’s property. The inheritors and executors often face a long list of required forms and filings, which can become overwhelming. First, ensure the estate is being handled by a good attorney and CPA. Our team provides services including inventory and documentation of appraisal property and appraisal services, if required.

Deconstruction is the careful dismantling of a structure with the intent to salvage and reuse the materials and property. Valuable property is kept out of the landfill reducing the construction industry’s carbon footprint and property can be reused and repurposed by providing affordably priced materials.

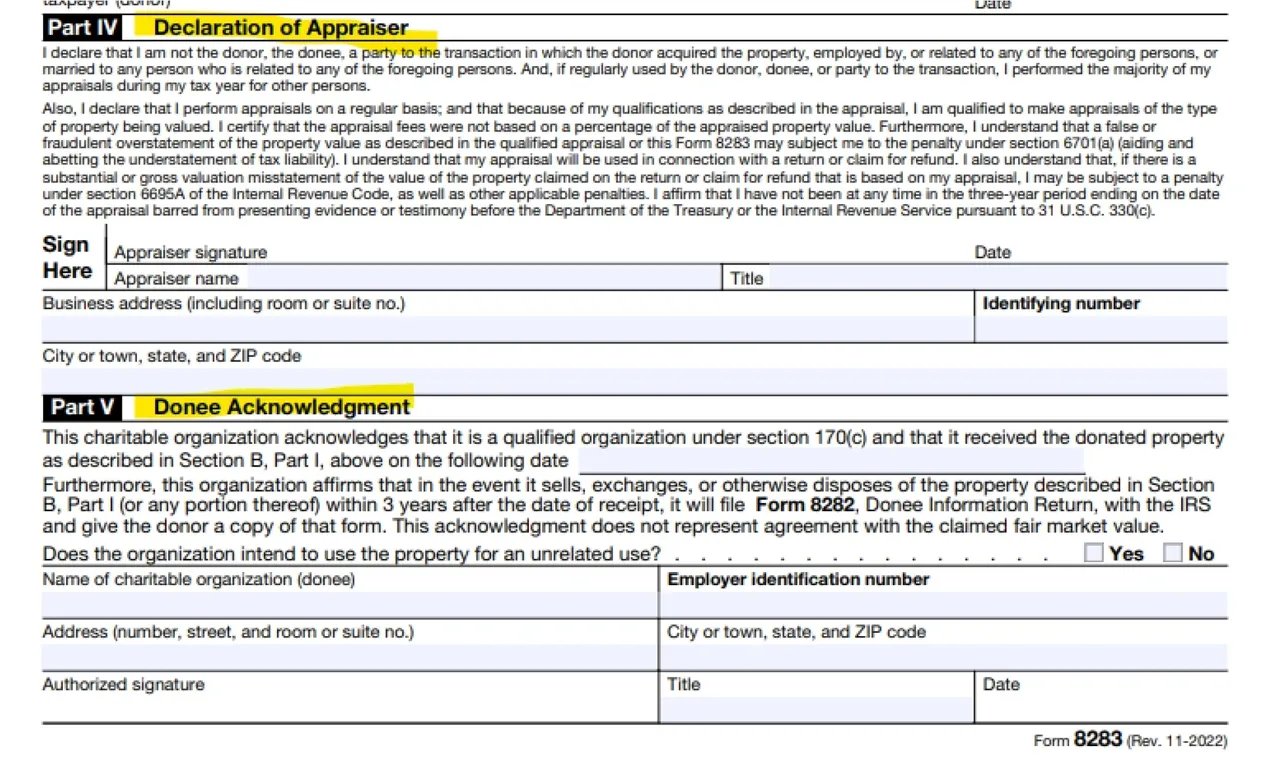

26 USC Section 170 is law. Ensuring a client hires a Qualified Appraiser to produce a Qualified Appraisal is law. USPAP is more critical than ever. As of 2019, all appraisers must follow the substance and principles of USPAP. See below for more regarding USPAP.

The Green Mission Inc. has been working in the sustainable built environment for three years offering our clients IRS Qualified Appraisals. These appraisals are to substantiate the value of materials and property extracted during the process of deconstruction.

The Green Mission Inc. and Probity Appraisal Group executives Jessica I. Marschall, CPA, ISA AM, AAA Associate Member, and Mayur Dankhara, ISA AM, LEED AP attended the ASA annual conference and left with boatloads knowledge! From the emergence of NFTs to luxury fashion value, the conference was an intellectual feast. Be on the lookout for more updates from our team.

CPAs and tax attorneys often have clients taking non-cash charitable contributions for building materials and other property incident to a home deconstruction. Deconstruction involves the careful dismantling of a structure with the intent of salvaging materials for reuse in new structures.