President & CEO, The Green Mission Inc. ~ December 20th, 2025

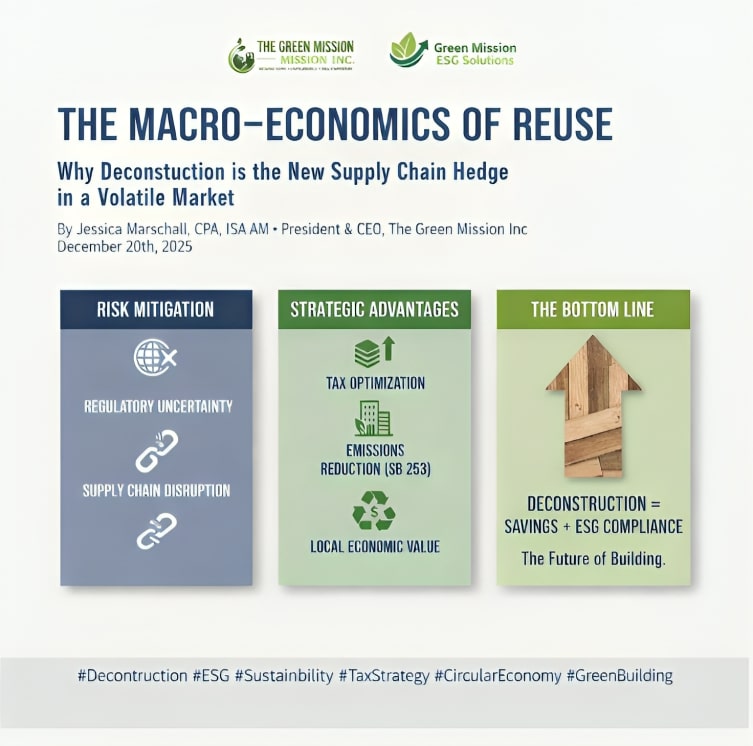

In the current global economic climate, the built environment is facing a perfect storm. Fluctuating trade tariffs, volatile raw material costs, and an evolving patchwork of state and international climate regulations have transformed traditional demolition from a standard operating procedure into a financial liability, and an environmental one.

At The Green Mission Inc. and GM-ESG, we are observing a fundamental shift in how sophisticated developers, corporations, and property owners approach end-of-life building decisions. Salvaged building materials are no longer confined to boutique “upcycling” projects or architectural salvage enthusiasts. Instead, they have become a strategic asset class for the modern developer and corporation seeking to manage risk, reduce costs, and meet emerging compliance requirements.

The Shifting Regulatory Landscape: A Patchwork of Disclosure Requirements

Federal Climate Rules: Current Status

The federal regulatory environment for climate disclosure has been in flux. In March 2024, the Securities and Exchange Commission adopted landmark rules requiring public companies to disclose material climate-related risks and greenhouse gas emissions. However, these rules were immediately challenged in court and voluntarily stayed by the SEC pending judicial review.

In March 2025, the SEC under the new administration withdrew its defense of these rules, and in September 2025, the Eighth Circuit placed the litigation in abeyance, effectively leaving the federal climate disclosure rules in regulatory limbo. As of December 2025, the SEC has neither rescinded nor defended the rules, creating uncertainty for public companies planning their disclosure strategies.

Importantly, the SEC’s original rules did not require Scope 3 emissions reporting (indirect emissions from a company’s value chain, including waste disposal), though material Scope 1 and 2 emissions disclosure was contemplated.

California Steps Into the Void: SB 253 and SB 261

While federal action stalls, California has emerged as the de facto regulatory leader. Two groundbreaking laws signed in October 2023 are moving forward despite legal challenges:

SB 253 (Climate Corporate Data Accountability Act): Requires U.S.-based companies with over $1 billion in annual revenue doing business in California to report their Scope 1 and 2 greenhouse gas emissions by August 2026, with Scope 3 emissions reporting beginning in 2027. This law notably includes Scope 3 emissions—which encompasses end-of-life treatment of products, waste generated in operations, and construction and demolition debris.

SB 261 (Climate-Related Financial Risk Act): Requires companies with over $500 million in annual revenue to publish biennial reports on climate-related financial risks. However, on November 18, 2025, the Ninth Circuit granted a preliminary injunction blocking enforcement of SB 261 pending appeal, while SB 253 remains in effect.

The California Air Resources Board (CARB) is proposing an August 10, 2026 deadline for initial SB 253 Scope 1 and 2 emissions reporting. For the first reporting cycle, CARB has indicated it will evaluate “good faith efforts” when considering compliance, providing some flexibility as companies build their reporting infrastructure.

International Pressures: EU CSRD

The European Union’s Corporate Sustainability Reporting Directive (CSRD) requires comprehensive Scope 3 emissions disclosure for large companies, with reporting phased in beginning in 2025. For multinational corporations or those with significant EU operations, this creates additional compliance obligations that include value chain emissions—encompassing construction, demolition, and waste management activities.

What This Means for the Built Environment

The practical implications are significant: companies subject to SB 253 will need to account for and report emissions from construction and demolition waste as part of their Scope 3 inventory. Traditional demolition generates substantial carbon emissions through landfill disposal, transportation, and embodied carbon loss. Deconstruction offers a documented, verifiable pathway to reduce these reportable emissions while generating economic value.

Tariffs, Timber, and the Cost of "New"

2025: A Year of Unprecedented Material Price Volatility

Construction material prices have experienced exceptional volatility in 2024-2025. According to the National Association of Home Builders (NAHB), building material costs are up 34% since December 2020—far exceeding general inflation. Framing lumber prices have increased approximately 12.7% year-over-year as of late 2025, with prices exceeding $900 per thousand board feet in some markets.

The primary driver of this volatility is tariff policy. Current countervailing and anti-dumping duties on Canadian softwood lumber stand at 14.5%, but the U.S. Department of Commerce has issued preliminary determinations to more than double this levy to 34.5% by September 2025. Combined with proposed additional tariffs, total effective duties on Canadian lumber could approach 40%.

The impact extends beyond lumber. Approximately 70% of gypsum imports (used for drywall) come from Mexico, and tariff proposals on Mexican goods would significantly increase drywall costs. Steel, aluminum, and copper have all seen tariff-related price increases. NAHB estimates that recent tariff actions could add approximately $9,200 to $10,900 to the average cost of a new home.

Supply Chain Vulnerabilities Exposed

The United States produces approximately 35 billion board feet of lumber annually but consumes around 50 billion board feet, which is a structural deficit that cannot be quickly remedied through domestic production. Canadian mill closures in response to tariffs and weak market conditions have reduced North American softwood lumber production capacity by an estimated 3.1 billion board feet according to industry analysts.

This supply constraint creates a fundamental economic reality: when the price of new lumber or imported materials spikes, the relative value of high-quality salvaged materials rises in tandem. Salvaged dimensional lumber, hardwood flooring, architectural millwork, and cabinetry become not just environmentally preferable alternatives but economically competitive ones.

The Secondary Materials Market: A $709 Billion Opportunity

The global green building materials market is growing at a 14% compound annual rate, from $332 billion in 2024 to a projected $709 billion by 2030. The secondary materials market—which includes reclaimed lumber, architectural salvage, and deconstructed building components—is positioned to capture a meaningful share of this growth as supply chain pressures drive demand for alternatives to virgin materials.

The Tax Mechanics: Turning Waste into Wealth

How Deconstruction Creates Tax Value

Deconstruction involves carefully dismantling a building piece by piece, salvaging materials for reuse rather than crushing them into landfill debris. Industry data suggests that 85% to 90% of a typical structure can be recycled or repurposed through proper deconstruction techniques.

When these salvaged materials—lumber, plumbing fixtures, cabinetry, doors, windows, flooring, lighting, HVAC components, and architectural elements—are donated to a qualified 501(c)(3) nonprofit organization, the property owner may claim a charitable contribution deduction based on the fair market value of the donated materials.

Real-World Economics

Consider the economics of a typical 2,000 square foot residential structure:

Traditional demolition: Approximately 2 days, costing $10,000-$15,000 including disposal fees

Deconstruction: 10-15 business days, costing $18,000-$35,000 depending on complexity

Potential donation value: $50,000 to $170,000 depending on the quality of materials, fixtures, and finishes

For a taxpayer in a 40% combined federal and state tax bracket, a $150,000 donation value translates to approximately $60,000 in tax savings—often exceeding both the cost differential between demolition and deconstruction AND the entire deconstruction cost itself.

Commercial projects offer even more dramatic results. A recent 1.1 million square foot commercial campus in Illinois was purchased for $9.5 million and, through comprehensive deconstruction and donation of fixtures, flooring, electrical systems, and building materials, generated an $8.9 million charitable deduction—effectively recovering nearly the entire purchase price through tax benefits.

However, a major caveat here is to consider basis and depreciation prior to considering the tax deduction. The non-cash charitable contribution is relegated to qualifying property at basis.

IRS Compliance Requirements

To claim deductions for donated building materials, strict IRS requirements must be met:

Qualified Appraisal: For donations exceeding $5,000, a qualified appraisal must be conducted by a qualified appraiser no earlier than 60 days before the donation date and no later than the tax return filing deadline.

Form 8283: Section B must be completed for donations over $5,000, with the appraiser signing Part IV and the donee organization acknowledging receipt.

Contemporaneous Documentation: Detailed inventory lists, photographs, condition assessments, and donation receipts must be maintained.

The IRS actively scrutinizes noncash charitable contributions, and inadequate documentation results in total disallowance regardless of the actual value donated. This is precisely why working with experienced, IRS-qualified appraisers is essential—not optional.

The Circular Economy: Moving from Linear to Loop

The Problem with "Take-Make-Dispose"

The United States generates approximately 600 million tons of construction and demolition debris annually, more than twice the amount of municipal solid waste. The vast majority of this material ends up in landfills, representing both an environmental burden and a massive loss of embodied energy and economic value.

Traditional demolition perpetuates a linear economy: extract raw materials, manufacture products, use them briefly, and dispose of them. This model is increasingly untenable in a world of supply chain disruptions, rising material costs, and carbon constraints.

Deconstruction as Market Infrastructure

Deconstruction enables a circular economy by treating buildings as “material banks”, or repositories of valuable components that can be returned to productive use rather than destroyed. A single deconstructed house can yield the equivalent of 44 trees worth of salvaged lumber, along with fixtures, finishes, and architectural elements that would otherwise be crushed into aggregate.

Cities including Oakland, California; Portland, Oregon; and Vancouver, Canada have implemented deconstruction requirements that mandate salvage of reusable materials before demolition permits are issued. France has launched national policies favoring deconstruction since 2015. The Netherlands aims to halve primary raw material use in construction by 2030. These policies reflect growing recognition that the secondary materials market requires supply-side intervention to achieve critical mass.

Local Economic Stabilization

Beyond corporate balance sheets, deconstruction acts as a stabilizer for local economies. By channeling high-quality materials to nonprofit warehouses and salvage operations like Habitat for Humanity ReStores, Community Forklift, Construction Junction, Building Value Cincinnati, Sustainable Warehouse, Repurpose Savannah, Reclaimed Materials Resource Management Co., Revolvs Salvage Inc., Sustainability Angels, Reuse Hawaii, ReSource Central and hundreds of other retailers and local building material exchanges, deconstruction creates a secondary market immune to international shipping delays and tariff volatility.

This secondary market provides local contractors, renovators, and homeowners with affordable alternatives to volatile virgin materials while creating local jobs in salvage, logistics, and retail operations.

Strategic Implementation: Making Deconstruction Work

Due Diligence and Planning

Successful deconstruction begins with proper due diligence. Before acquisition or renovation, engage qualified appraisers to assess salvage potential and estimate donation values. This preliminary analysis informs acquisition decisions and helps structure transactions to maximize tax benefits.

Timing Considerations

Deconstruction can often begin on a structure’s interior while permitting for new construction is still in process, reducing overall project timelines. Material values fluctuate with market conditions—when new material prices spike, salvaged material values typically follow, potentially increasing donation values.

Documentation and Compliance

Maintain comprehensive records throughout the process. The preliminary appraisal, inventory lists, photographs, donation receipts, and final reconciliation documents form the foundation for IRS-compliant deduction claims. For companies subject to climate disclosure requirements, this same documentation provides the verifiable data needed to quantify waste diversion and emissions reductions.

The Bottom Line: A Sophisticated Financial Hedge

Deconstruction is not merely an environmental preference—it is a sophisticated financial strategy that addresses multiple risks simultaneously:

Material cost risk: Creates access to secondary materials immune to tariff volatility

Disposal cost risk: Eliminates or dramatically reduces tipping fees through donation

Tax optimization: Generates charitable deductions that often exceed deconstruction costs

Regulatory compliance: Provides documented, verifiable emissions reductions for California SB 253 and EU CSRD reporting

Reputational value: Demonstrates genuine commitment to sustainability with quantifiable metrics

In an environment of 34%+ tariffs on Canadian lumber, $9,200+ per-home material cost increases, emerging Scope 3 reporting requirements, and growing stakeholder expectations for demonstrable climate action, deconstruction has evolved from a niche environmental practice to a mainstream business strategy.

The question is no longer whether deconstruction makes sense, it is whether you can afford not to consider it.

About the Author

CPA, ISA AM President & CEO The Green Mission Inc.

Jessica Marschall, CPA, ISA AM, is President and CEO of The Green Mission Inc., a leading deconstruction appraisal and valuation firm, as well as MAS LLC (tax advisory), Probity Appraisal Group (art and antiques valuation), and GM-ESG (corporate decommissioning and ESG reporting). With 26 years of tax experience and six years specializing in deconstruction appraisals, she and her team complete approximately 500 to 1,000 IRS-compliant deconstruction appraisals annually. She has authored over 150 articles on tax, valuation, and sustainable building practices.

Contact: www.TheGreenMissionInc.com

Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. Tax laws, regulations, and climate disclosure requirements are complex and subject to change. The status of California SB 253 and SB 261, SEC climate rules, and international regulations should be verified for current applicability. Consult with qualified tax, legal, and appraisal professionals regarding your specific situation.

© 2025 The Green Mission Inc. All rights reserved.