As I begin my second term on the Board of Directors of Rethos now serving as Treasurer, I find myself at a unique vantage point.

We have a unique insight into the reclaimed building materials market, specifically lumber, as we value these materials at IRS-defined Fair Market Value for noncash charitable donation purposes.

People often ask me what a typical week looks like in the deconstruction appraisal business. The answer is that no two weeks are ever alike; but the volume and variety of work would surprise most.

Over the past two months, The Green Mission Inc. and GM-ESG have completed multiple IRS-qualified appraisals for deconstruction projects throughout the greater Charleston, South Carolina area.

After more than six decades at its Wells Street location, the Milwaukee Public Museum is embarking on the largest cultural project in Wisconsin history.

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduces significant changes to charitable contribution deductions that will directly impact donors of deconstructed building materials, household furnishings, and other tangible personal property beginning January 1, 2026.

When property owners choose deconstruction over demolition, they unlock powerful tax benefits through charitable contributions that can offset, or sometimes even exceed, additional project costs. Yet the pathway from salvaged materials to legitimate tax deductions is fraught with technical requirements that, if overlooked, trigger complete disallowance of these benefits. The IRS has transformed noncash charitable contributions into an enforcement priority, wielding strict procedural standards as their primary weapon against perceived abuse.

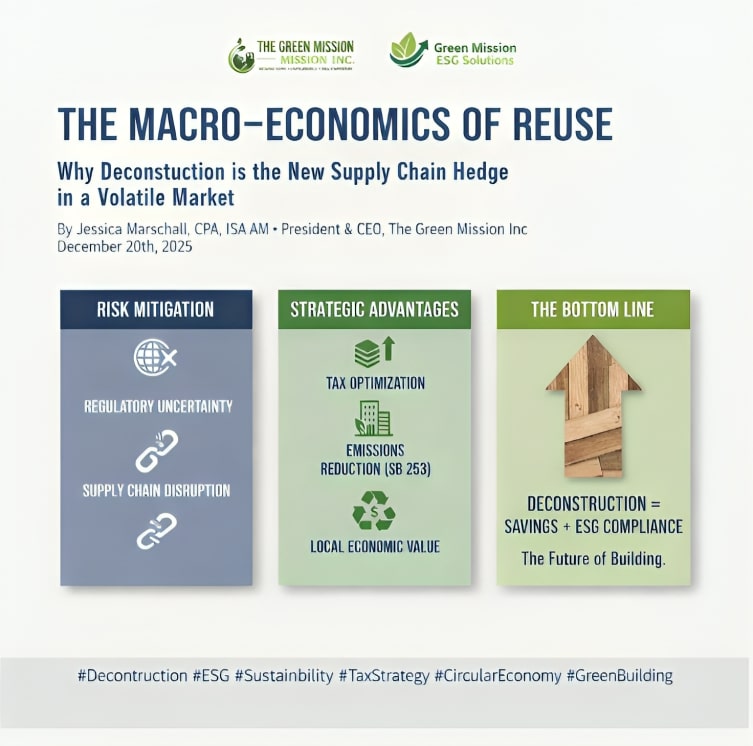

In the current global economic climate, the built environment is facing a perfect storm. Fluctuating trade tariffs, volatile raw material costs, and an evolving patchwork of state and international climate regulations have transformed traditional demolition from a standard operating procedure into a financial liability, and an environmental one.

A deconstruction appraisal is a personal property appraisal that determines the Fair Market Value of salvaged building materials, …

The United States produces over 600 million tons of construction and demolition debris annually—the single largest waste stream in the nation. According to the EPA, demolition accounts for more than 90 percent of this staggering figure. In Colorado alone, an estimated one-third of all landfill waste originates from the construction and demolition industry.