The transformation of construction and demolition waste streams into viable secondary material markets represents one of the most significant yet underachieved opportunities in sustainable development. Despite compelling environmental imperatives and theoretical frameworks supporting circular economy principles, the secondary market for building materials and decommissioned corporate property (furniture, fixtures, appliances, and related assets) continues to operate at only a fraction of its potential capacity.

The global green building materials market is on pace to nearly double, from $332.1 billion in 2024 to $708.9 billion by 2030. This represents a significant 14% compound annual growth rate (CAGR), placing it among the fastest-growing sectors within construction and real estate. The CAGR itself tells a powerful story: it indicates not just linear expansion, but a compounding acceleration of market demand year over year. At this pace, the sector is projected to add nearly $377 billion in new market value in just six years.

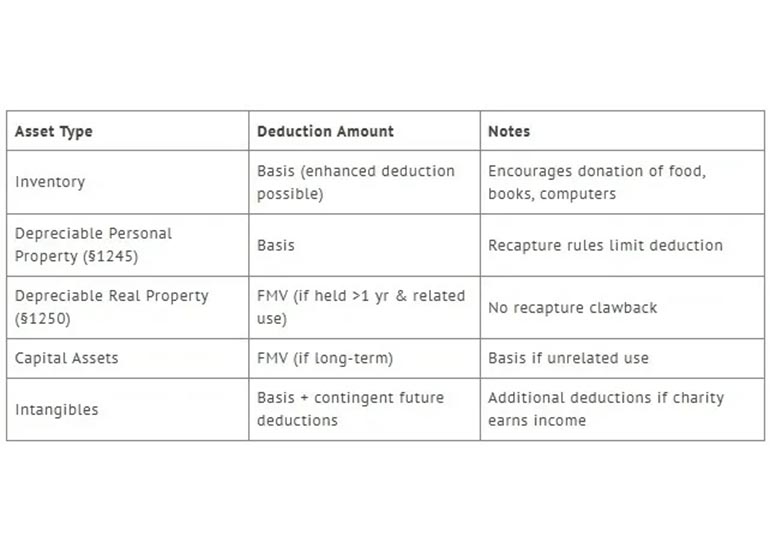

For corporations, donating property to charity can be more than an act of goodwill, it can also generate meaningful tax savings. Yet not all property is treated the same under the Internal Revenue Code. Some assets qualify for a deduction at their full fair market value (FMV), while others are limited to the company’s basis. Knowing these rules is critical for tax planning, compliance, and maximizing the benefit of charitable giving.

The housing market in the United States is navigating a difficult landscape. Existing home sales in June 2025 sank to their lowest level in nine months, declining by 2.7 percent to an annualized rate of 3.93 million units.

Antique barns remain one of the richest sources of high-quality reclaimed softwood and hardwood in North America.

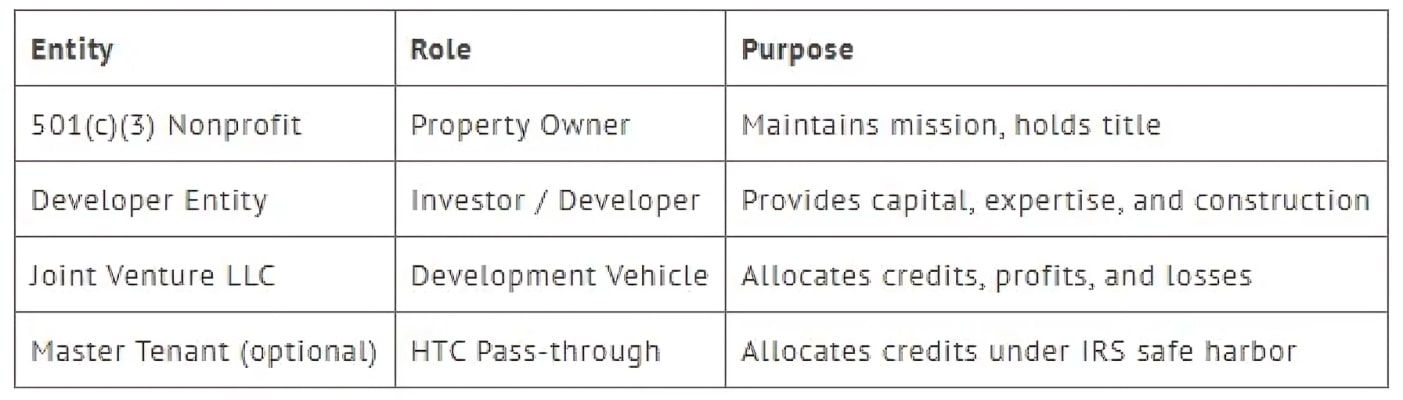

The Federal Historic Tax Credit (HTC) remains at 20 percent, applied to the eligible rehabilitation costs of income-producing historic properties. This incentive is critical for the rehabilitation of income-generating portions of qualified properties such as historic theaters.

Since the inception of The Green Mission Inc., Probity Appraisal and recently GM-ESG, I have had the privilege of working alongside an exceptional colleague and friend, Jennie Lumpkin. From the very beginning, Jennie has been an integral part of our organization’s growth and success, shaping our approach to client service, operational excellence, and industry leadership.

My recent visit to Madrid was built around a dual focus: studying architectural salvage traditions through the city’s premier museums and buildings, and understanding how Spain is embedding deconstruction and circularity into its building sector. The combination offers a compelling case study in how a city can value its past while engineering a lower-carbon, resource-conscious future.

The Alhambra in Granada, Spain, is one of the most complete surviving examples of Islamic architecture in Europe. During a recent visit, I studied the construction and decorative features of this palace complex to gain insight into the intentionality behind each element.

The One Big Beautiful Bill (OBBB), passed in 2025, includes several sweeping changes to the U.S. tax code, many of which directly impact charitable giving strategies, particularly for taxpayers who itemize deductions. One of the most consequential changes is the introduction of a 0.5% adjusted gross income (AGI) floor on non-cash charitable contributions, which restricts the deductibility of lower-value in-kind gifts. However, an equally important and often overlooked change is the reinstatement of a cap on total itemized deductions, a provision that mirrors the spirit and structure of the former Pease limitation.