In the recent Mann v. United States case, the federal court of appeals set important precedent in determining how deconstructed and donated building materials, furnishings, and fixtures should be valued in line with IRS defined Fair Market Value. Along with proper and accurate valuation comes two equally important issues: what does and does not constitute an IRS defined Qualified Appraisal and Qualified Appraiser? We first provide an overview of deconstruction and its tax implications, and then address the impact of the Mann case.

The Green Mission Inc. works closely with clients who choose to donate personal property from their estate to charities. Not only does this give the property a second life, it directly impacts the lives of those for whom charities offer aid and support. Charitable purposes and missions range from providing furnishings for those moving into stable housing, support for those in drug treatment programs, to providing furnishings, fixtures, and appliances to underserved populations for free or reduced prices, and myriad missions that help those across the country—from inner cities to rural communities.

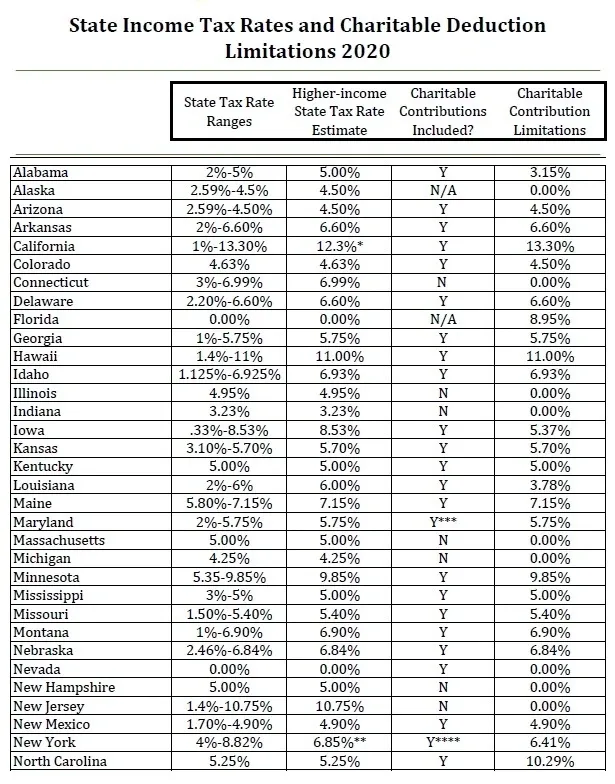

State Income Tax Rates and Charitable Deduction Limitations 2020

Nonprofits, charities, churches, and governmental entities need charitable contributions to support their missions and operations. Whether educating children, helping families move into homes, providing drug treatment programs, delivering computers to young learners, and the many other worthy endeavors too lengthy to enumerate.

As noted in our appraisal, we primarily employ the Sales Comparison Approach in determining the Fair Market Value. Below includes a definition of this approach by two personal property appraisal organizations and our consideration of both asking prices and consummated sales in our opinions of value.

The past two years have been a whirlwind of professional excitement since entering the deconstruction and appraisal space. I ran and concurrently run a small tax consultation practice of 19 years. It was fascinating to delve into the appraiser practitioner side of tax form 8283 and research the interrelated fields of tax policy for non-monetary charitable contributions along with personal property appraisal methodology and theory.

Real Estate and Personal Property Appraisals: Similarities and Differences

Clients often ask if they can deduct a monetary pledge to a nonprofit. Typically, these pledges occur when a nonprofit is involved in a residential or commercial deconstruction project. Careful tax consideration of pledges is necessary to ensure compliance with the Internal Revenue Code.

The process of deconstruction is to carefully dismantle existing structures with the intent of salvaging and reusing materials and fixtures with remaining useful life. These services are an environmentally friendly alternative to demolishing and throwing the contents into the dumpster, and eventually, the landfill.

Appraisal Principles and Procedures, Henry A. Babcock, FASA is the core course publication used by the American Society of Appraisers (ASA) as a textbook for becoming a credentialed member of their organization. Information and procedures outlined within the text can be applied to what we call “deconstruction appraisals.” Some suggest alternate titles such as “Architectural Salvage Appraiser,” or, “Reuse Appraiser,” The title does not matter; the valuation methodology does. There is no defined category for appraisals of these type within ASA at this time, however we expect the demand for these appraisals to continue to increase as deconstruction ordinances are passed and circular economy goals become more widely embraced. Individuals and businesses will discover tax deductions for the value of these materials as an attractive tax savings. Throughout this textbook, Babcock provides critical analysis that must be considered when valuing materials and property for income tax deduction purposes, and by extension, by deconstruction, architectural salvage or reuse appraisers. We will stick to “deconstruction appraiser” for the remainder of this writing for simplicity.