The construction industry is undergoing a fundamental transformation—one driven not only by climate urgency but by market logic. According to McKinsey & Company’s recent article, “How Circularity Can Make the Built Environment More Sustainable,” the adoption of circular practices in construction could reduce up to 75 percent of embodied carbon emissions by 2050 and create as much as $360 billion in net value gains across key building materials. These gains are not speculative—they are grounded in realistic shifts in material sourcing, reuse, and system redesign.

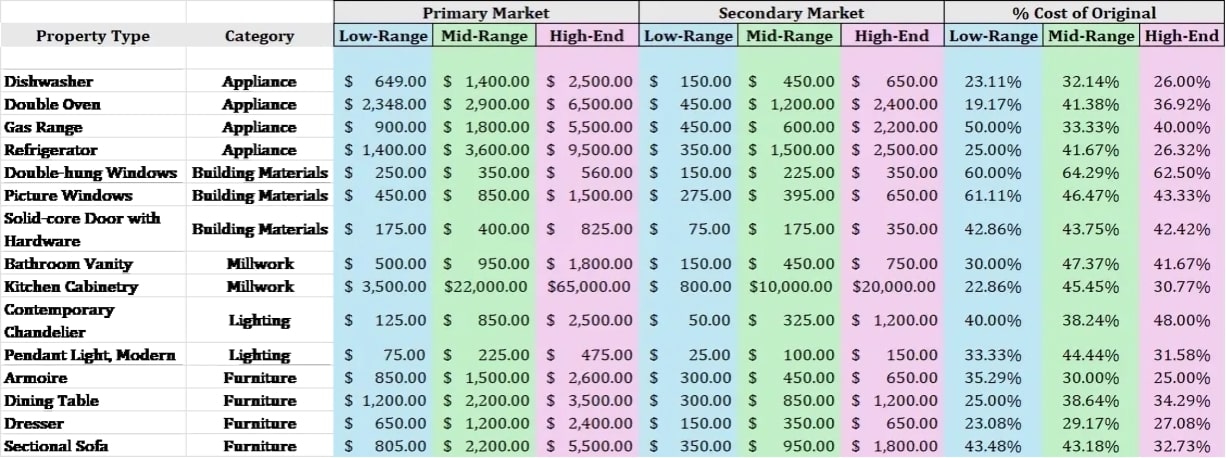

For over two decades, advocates of “deconstruction” and material reuse have touted the environmental and economic benefits of salvaging building components. Yet the secondary market for used building materials and furnishings has remained stubbornly underdeveloped, with low demand and low value relative to new goods. Today, however, a new factor is emerging that could tip the scales: escalating U.S. tariffs on a wide range of imported goods. As trade barriers drive up the cost of new building materials, appliances, and household items, the enormous price gap between new and used goods presents a timely opportunity to finally make reuse mainstream. But seizing this moment will require overcoming long-standing supply chain challenges through unprecedented coordination between nonprofits and for-profit firms.

The choice of lumber used in residential home construction in the United States is heavily influenced by regional forest resources, climate conditions, and supply chain logistics. While most homes utilize standard dimensional lumber, the species and grades vary considerably based on location. This article outlines the most commonly used framing lumber types across major U.S. regions.

Two decades after the inception of the “deconstruction” movement, the secondary market for reused building materials remains underwhelming in both demand and value. Despite tens of millions of dollars awarded to individuals and organizations for regional assessments, feasibility studies, model programs, and attempts to create uniform sales practices, the fundamental issues persist:

The Green Mission Inc. is thrilled to announce the formation of its Youth Coalition for Sustainable Deconstruction, an innovative initiative dedicated to gathering and amplifying the voices of young people with a passion for sustainable building practices. This coalition will serve as a vibrant platform for university students, trade students, emerging professionals, and anyone with a vested interest in the deconstruction industry. The Youth Coalition is designed to empower and inspire the next generation to engage with sustainable deconstruction practices and make meaningful contributions to a more circular economy.

The Green Mission Inc. has spent the past five years deeply involved in examining and reporting on the valuation metrics of the secondary market for building materials. As industry leaders in deconstruction valuations and sustainability practices, we have seen firsthand the significant untapped potential within this market. Through our work, we have identified strategies to maximize the value of salvaged materials while promoting sustainability. This article delves into how transforming the secondary market can create a more efficient, value-driven supply chain that benefits consumers, businesses, and the environment, unlocking new opportunities for growth and innovation.

In recent years, deconstruction has emerged as a powerful force driving sustainability in the construction and renovation industry. By prioritizing the careful disassembly and salvage of materials, deconstruction not only reduces waste but also contributes to the reuse and recycling industry. Crucially, one of the key drivers behind the increasing adoption of deconstruction by homeowners is the availability of financial incentives, particularly in the form of tax benefits. Here, we delve into how these tax benefits are helping propel the reuse and recycle industry forward while providing homeowners with compelling reasons to choose deconstruction over traditional demolition.

Are you a commercial property owner facing the daunting task of orchestrating a corporate clean-out or remodel? Are there perfectly reusable furnishings, appliances, desks, computers, cubicles, or cabinetry slated to be discarded now or in the future? Would you be open to learning the benefits of waste diversion and contributing to make this world a safer, greener place for generations to come? Would you also potentially like to save money in the process and feel good about your business choices?

The market for buying used building materials can vary depending on your location, but there are several common options to consider:

The IRS has recently announced that they will be concentrating staffing efforts towards High Net Worth (HNW) and pass-through entities. Individuals usually taking non-cash charitable donations are often HNW. It is critical that our clients and their CPAs and tax advisors understand the risks and the requirements for an IRS Qualified Appraisal produced by an IRS Qualified Appraiser.