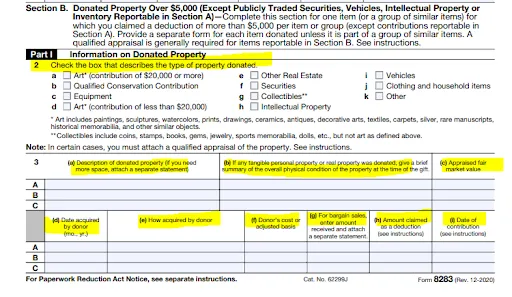

The Green Mission Inc. has been working in the sustainable built environment for three years offering our clients IRS Qualified Appraisals. These appraisals are to substantiate the value of materials and property extracted during the process of deconstruction.

CPAs and tax attorneys often have clients taking non-cash charitable contributions for building materials and other property incident to a home deconstruction. Deconstruction involves the careful dismantling of a structure with the intent of salvaging materials for reuse in new structures.

The thrill of leaving a thrift store with a huge load of clothing, dishes, furniture, or appliances for a fraction of the price of buying new is fantastic! Finding a set of 150-year-old doors or a simple set of kitchen cabinets that can be painted to look like new and save thousands of dollars… gold!

By necessity, deconstruction typically costs more than demolition due to the additional time needed to carefully take apart a structure with the aim of preserving the salvaged elements—opposed to the break-and-dump processes of demolition. However, these costs can be offset through tax deductions.

The most effective way to protect yourself and ensure your appraisal is accurate, fully documented, and substantiates the value is to hire an educated and competent appraiser.

The exciting work of deconstruction continues across the country with Pittsburg being the latest city to adopt a deconstruction ordinance:

Deconstruction is the process in which a building is taken apart, piece-by-piece, with the aim of salvaging and reusing as many materials as possible. The scope of a deconstruction project can be as small as a bathroom renovation or the dismantling of a larger residential or commercial structure.

Tax policy aligning with environmental initiatives is a wonderful and rare occurrence within the Internal Revenue Code. An individual may choose to deconstruct, or “un-build” a structure and donate the materials to charity, rather than demolishing the structure and sending materials to the landfill. When donated to a 501(c)3 charity or governmental entity, a tax deduction can be taken for the IRS defined Fair Market Value of the materials, fixtures, furnishings, appliances and other property incident to the deconstruction. These materials and property have solid value on the secondary retail “resale” market.

As a practicing CPA of 19 years, mid-February is when I question my career choices as days disappear in tax and appraisal work with very little sleep. My experiences preparing work for IRS review carries over to my appraisal practice in critical ways.

Nonprofits, charities, churches, and governmental entities need charitable contributions to support their missions and operations. Whether educating children, helping families move into homes, providing drug treatment programs, delivering computers to young learners, and the many other worthy endeavors too lengthy to enumerate.