Charitable Giving Under the One Big Beautiful Bill Act: A New Era of Incentives and Complexity, Especially for Non-Cash Donations

The Internal Revenue Code (IRC) Section 170 provides valuable tax incentives for C Corporations to donate inventory to qualified charitable organizations. Specifically, Section 170(e)(3) allows an enhanced charitable deduction for inventory donations, a provision designed to encourage businesses to contribute surplus goods to nonprofits rather than discarding them or selling them at a loss. Below, we explore the details of this provision, including how the deduction is calculated, substantiation requirements, and when an appraisal is necessary.

Non-cash charitable contributions, particularly those exceeding $5,000, have become a focal point for IRS enforcement and Tax Court rulings. While charitable giving provides an opportunity to benefit both the donor and the receiving organization, it also requires fastidious compliance with documentation requirements to withstand the heightened scrutiny of tax authorities. This article outlines key Tax Court cases, IRS substantiation rules, and proactive strategies for ensuring non-cash charitable contributions meet all necessary requirement.

Historic preservation and deconstruction go hand-in-hand. Our CEO Jessica I. Marschall, CPA, ISA AM, recently joined the Minnesota-based Rethos Board of Directors. With her background in tax and deconstruction tax deductions, she hopes to assist in educating others about the distinctions between historic preservation versus deconstruction and encouraging the responsible and thoughtful approach to handling historic structures and materials.

After the passing of a loved one, local, state, or federal courts often request an appraisal of the decedent’s property. The inheritors and executors often face a long list of required forms and filings, which can become overwhelming. First, ensure the estate is being handled by a good attorney and CPA. Our team provides services including inventory and documentation of appraisal property and appraisal services, if required.

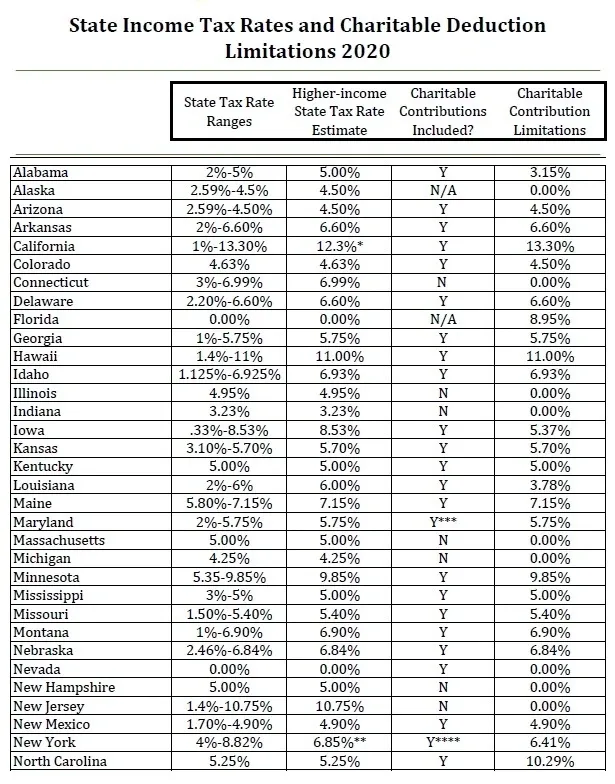

State Income Tax Rates and Charitable Deduction Limitations 2020

Clients often ask if they can deduct a monetary pledge to a nonprofit. Typically, these pledges occur when a nonprofit is involved in a residential or commercial deconstruction project. Careful tax consideration of pledges is necessary to ensure compliance with the Internal Revenue Code.

The process of deconstruction is to carefully dismantle existing structures with the intent of salvaging and reusing materials and fixtures with remaining useful life. These services are an environmentally friendly alternative to demolishing and throwing the contents into the dumpster, and eventually, the landfill.