Are you a commercial property owner facing the daunting task of orchestrating a corporate clean-out or remodel? Are there perfectly reusable furnishings, appliances, desks, computers, cubicles, or cabinetry slated to be discarded now or in the future? Would you be open to learning the benefits of waste diversion and contributing to make this world a safer, greener place for generations to come? Would you also potentially like to save money in the process and feel good about your business choices?

The market for buying used building materials can vary depending on your location, but there are several common options to consider:

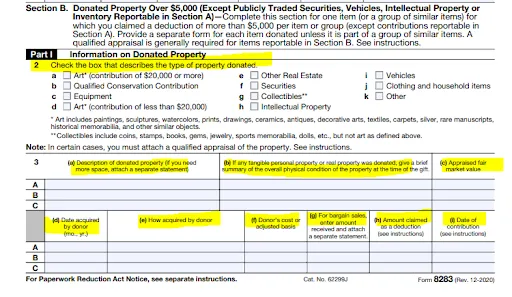

The IRS has recently announced that they will be concentrating staffing efforts towards High Net Worth (HNW) and pass-through entities. Individuals usually taking non-cash charitable donations are often HNW. It is critical that our clients and their CPAs and tax advisors understand the risks and the requirements for an IRS Qualified Appraisal produced by an IRS Qualified Appraiser.

The Green Mission Inc. has been working in the sustainable built environment for three years offering our clients IRS Qualified Appraisals. These appraisals are to substantiate the value of materials and property extracted during the process of deconstruction.

CPAs and tax attorneys often have clients taking non-cash charitable contributions for building materials and other property incident to a home deconstruction. Deconstruction involves the careful dismantling of a structure with the intent of salvaging materials for reuse in new structures.

The thrill of leaving a thrift store with a huge load of clothing, dishes, furniture, or appliances for a fraction of the price of buying new is fantastic! Finding a set of 150-year-old doors or a simple set of kitchen cabinets that can be painted to look like new and save thousands of dollars… gold!

By necessity, deconstruction typically costs more than demolition due to the additional time needed to carefully take apart a structure with the aim of preserving the salvaged elements—opposed to the break-and-dump processes of demolition. However, these costs can be offset through tax deductions.

The most effective way to protect yourself and ensure your appraisal is accurate, fully documented, and substantiates the value is to hire an educated and competent appraiser.

The exciting work of deconstruction continues across the country with Pittsburg being the latest city to adopt a deconstruction ordinance:

Tax policy aligning with environmental initiatives is a wonderful and rare occurrence within the Internal Revenue Code. An individual may choose to deconstruct, or “un-build” a structure and donate the materials to charity, rather than demolishing the structure and sending materials to the landfill. When donated to a 501(c)3 charity or governmental entity, a tax deduction can be taken for the IRS defined Fair Market Value of the materials, fixtures, furnishings, appliances and other property incident to the deconstruction. These materials and property have solid value on the secondary retail “resale” market.