By Jessica I. Marschall, CPA, ISA AM President & CEO The Green Mission Inc. | GM-ESG | Probity Appraisal Group | MAS LLC

Table of Contents

Part I: Foundations of Deconstruction Appraisals

Part II: The IRS Qualified Appraiser Standard

Part III: Valuation Methodology

Part IV: Real Property vs. Personal Property

Part V: Form 8283 Requirements

Part VI: Landmark Cases and Legal Precedents

Part VII: Best Practices for Appraisal Production

Part VIII: How to Evaluate an Appraiser

Part IX: The Appraisal Process

Part X: Tax Implications and AGI Limitations

Appendix: Key IRS References and Resources

Part I: Foundations of Deconstruction Appraisals

What is Deconstruction?

Deconstruction is the careful dismantling of a structure with the intent to salvage and reuse the materials and property. Unlike traditional demolition, which uses bulldozers and wrecking balls to quickly clear a site, deconstruction involves systematic “un-building” in reverse order of construction—extracting valuable property that would otherwise be gutted and dumped in landfills.

Materials commonly recovered through deconstruction include wood flooring, doors and jambs, windows, shutters, paver stones, millwork, kitchen cabinetry, appliances, door and drawer hardware, mantels, HVAC equipment, plumbing fixtures, and numerous other materials. The donation often includes furniture, office supplies, and other property that would have otherwise gone to the dumpster. These materials have solid value on the secondary retail “resale” market, some more than others. Lumber, a finite resource, holds value well, especially vintage or antique, but furniture depreciates rapidly. Higher-end and high quality appliances hold value while lower-quality are often only able to be recycled at best.

The Tax Incentive

Tax policy that aligns with environmental initiatives is a wonderful and rare occurrence within the Internal Revenue Code. When building materials are donated to a 501(c)(3) charity or governmental entity, a tax deduction can be taken for the IRS-defined Fair Market Value of the materials, fixtures, furnishings, appliances, and other property incident to the deconstruction.

This tax deduction can bridge the gap between more expensive and labor-intensive deconstruction over traditional demolition practices. In fact, approximately 90-95% of residential homeowners who undertake deconstruction over demolition do so specifically because of the tax deduction. When tax policy aligns with sound environmental practices, both the taxpayer and the environment benefit.

What is a Deconstruction Appraisal?

A deconstruction appraisal is a personal property appraisal that determines the Fair Market Value of salvaged building materials, furnishings, and fixtures that have been donated to a qualified charitable organization. For any donation valued at $5,000 or more, the IRS requires an IRS-defined “Qualified Appraisal” produced by an IRS-defined “Qualified Appraiser” to substantiate the charitable contribution deduction.

Critical to this deduction is proper documentation and correct valuation methodology. An unqualified appraisal or appraiser will not just impact the deduction—it could void it entirely and trigger penalties.

Part II: The IRS Qualified Appraiser Standard

Under the Internal Revenue Code and corresponding Treasury Regulations, a Qualified Appraiser is an individual who meets strict standards when preparing appraisals for non-cash charitable contributions. These requirements are primarily defined under IRC §170(f)(11)(E) and Treasury Regulation §1.170A-17.

Education and Experience Requirements

To be considered a Qualified Appraiser for federal tax purposes, an individual must:

- Have earned an appraisal designation from a recognized professional appraiser organization (e.g., International Society of Appraisers, American Society of Appraisers, Appraisers Association of America); OR

- Meet minimum education and experience requirements, including successful completion of college- or professional-level coursework in valuing the type of property being appraised, plus at least two years of experience in buying, selling, or valuing the type of property being appraised.

Regular Practice Requirement

The appraiser must regularly perform appraisals for compensation as part of their established business practice. This is not a hobby or occasional activity—it must be a consistent professional endeavor.

Independence and Ethical Compliance

The appraiser must:

- Not be the donor, the donee organization, a party to the transaction in which the donor acquired the property, or an employee, partner, or family member of any of these parties.

- Maintain independence and objectivity —they may not have a financial interest in the property or the outcome of the valuation.

- Comply with U.S. Treasury Department Circular No. 230, which governs practice before the IRS. This includes not having been disbarred, suspended, or sanctioned for ethical violations or criminal conduct.

Good Standing with the IRS

The appraiser must not have been prohibited from practicing before the IRS at any time during the three years preceding the date of the appraisal. Individuals with certain criminal backgrounds or disqualifying disciplinary history are prohibited from acting as Qualified Appraisers.

The Lack of Licensure Problem

Unlike certified public accountants, attorneys, or real estate appraisers, there is no state or federal licensure for personal property appraisers. This has historically allowed individuals without adequate education or experience to produce appraisals, sometimes resulting in inflated valuations and/or deficient work product that jeopardizes taxpayers’ deductions and harms the reputation of the entire industry.

There are three personal property appraisal organizations who sponsor the congressionally-authorized Appraisal Foundation, a nonprofit helping to heighten appraiser education and standards. They also promulgate USPAP, the Uniform Standards of Professional Appraisal Practice. To protect yourself, you should, at a minimum, ensure your appraiser is an accredited member of one of these organizations:

American Society of Appraisers (ASA)

Appraisers Association of America (AAA)

International Society of Appraisers (ISA)

Part III: Valuation Methodology

The Three Approaches to Value

There are three valuation methods to be considered when appraising personal property. Each must be evaluated in an appraisal with the appraiser determining which applies to the given assignment:

1. Sales Comparison Approach (Market-Based Approach)

This approach compares the subject property with similar items that have sold in the past within the market considered most common for the item. It involves researching and documenting consummated sales and offers of sale for comparable property in a relevant time frame and in the relevant market. This is the correct methodology for the overwhelming majority of deconstruction appraisals.

2. Cost Approach

This approach estimates the replacement cost of property using either new or used values, typically applying depreciation. It is used primarily for insurance appraisals when the insured seeks to be made whole. The Cost Approach should rarely, if ever, be used for deconstruction appraisals.

3. Income Approach

This approach calculates the present value of future cash flows from income-producing property. It is typically used for financial planning and business valuation purposes and is generally not applicable to deconstruction appraisals.

Why the Sales Comparison Approach Must Be Used

All three major personal property appraisal organizations—ASA, AAA, and ISA—agree that the Sales Comparison Approach is to be used for the majority of appraisals when determining Fair Market Value for income tax purposes. The IRS, courts, and professional appraisal standards all support this position.

From the International Society of Appraisers: “Using sales of comparable properties is the most common way that the appraiser will show evidence for a value conclusion. Users of appraisals, such as the IRS, find this method the most convincing.”

From the American Society of Appraisers: “The appraiser concludes the value of a property by comparing it with similar items sold in the relevant market. The appraiser identifies the characteristics of value seen in the similar properties that are available or have been sold.”

The Problem with Construction Cost Estimating Software

Due to the relatively obscure market of deconstruction appraisers, some appraisers continue to use the Cost Approach by plugging values into construction cost estimating software such as Marshall & Swift or RS Means, applying arbitrary depreciation, and calling it an appraisal. This is fundamentally incorrect.

The only noted IRS-approved use of RS Means software is in determining Cost Segregation Analysis for spreading construction expenses across accounting periods—not for calculating Fair Market Value of personal property.

An appraisal that should take 80-90 hours of combined office time in research and reporting can be produced in 30-60 minutes using software shortcuts. Even if the valuations happen to be similar to those reached through proper methodology, the IRS could disallow the appraisal because the appraiser used faulty valuation methods.

Comparable Sales Data Exists

Some appraisers claim that comparable sales data does not exist for deconstructed materials. This is false. There are 800+ secondary retail stores, websites, and auctions from which comparable sales data can be pulled in abundance. Comparable sales data for building materials and other household property have existed for at least the past decade. Our team adds new secondary retailers to our database every week.

Deconstruction and reuse appraisals rely heavily on retailers of second-hand building materials, home furnishings, home fixtures and appliances, and other varieties of household goods. Because of the nature of these retail outlets, the offer price is considered a reliable indicator of value. Multiple offer prices should be researched for each appraised item to look for patterns in pricing, eliminate outliers, and then apply statistical tools (mean, median, mode, and range) for analysis.

Part IV: Real Property vs. Personal Property

The Severance Principle

A critical distinction must be understood: when building materials are detached from real property, they immediately become personal property. The long-held legal definition of constructive severance is the conversion of real property to personal property at the moment of removal from the real property structure.

The value of an intact real property structure is almost always significantly higher than its detached personal property components. A real estate appraisal values land, improvements, and associated rights—but deconstructed materials are no longer real property and cannot be valued as such.

Why Values Decrease Upon Detachment

Once removed from the property, components lose their real estate designation and become personal property, leading to a reduction in market value due to:

- Depreciation and Condition Changes: Fixtures and materials experience immediate depreciation due to handling, transportation, and storage risks. Many components cannot be reinstalled without damage.

- Loss of Financing and Insurance Benefits: Detached items are no longer included in real estate appraisals or eligible for traditional property financing.

- Narrower Market Demand: The market for detached materials is far more limited. Most buyers seek new, warrantied products, which shrinks the demand pool and reduces resale values.

The Danger of Using Real Estate Values

Some deconstruction appraisers use real estate values, essentially valuing the pre-deconstructed building as the total real estate value less land value. This theory values the building as if it were being left intact and moved to a new location—which is incorrect for deconstructed materials.

Example:

A 4,500 square foot home has land value of $300,000 and improvement value of $500,000. After deconstruction, approximately $100,000 of materials were salvaged and donated. If the taxpayer had a real estate appraisal using the $500,000 improvement value, and they have a combined effective tax rate of 30%, they would realize a tax savings of $150,000. If valued correctly at $100,000, the tax savings would be $30,000. The overvaluation would be 400%—triggering potential disallowance and a 40% penalty. It is important to emphasize again and again that these penalties are on the taxpayer, not the appraiser or nonprofit.

The taxpayer must do their homework.

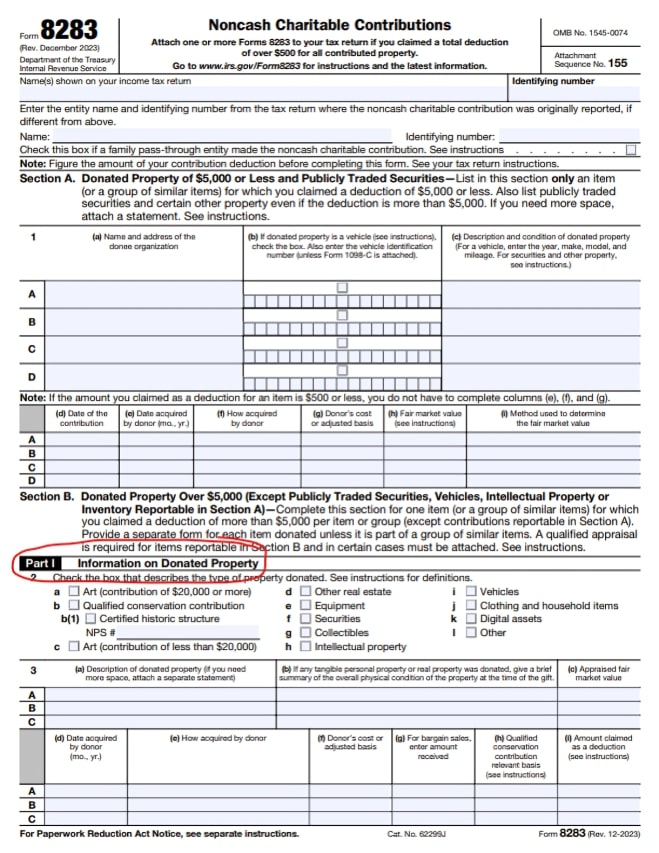

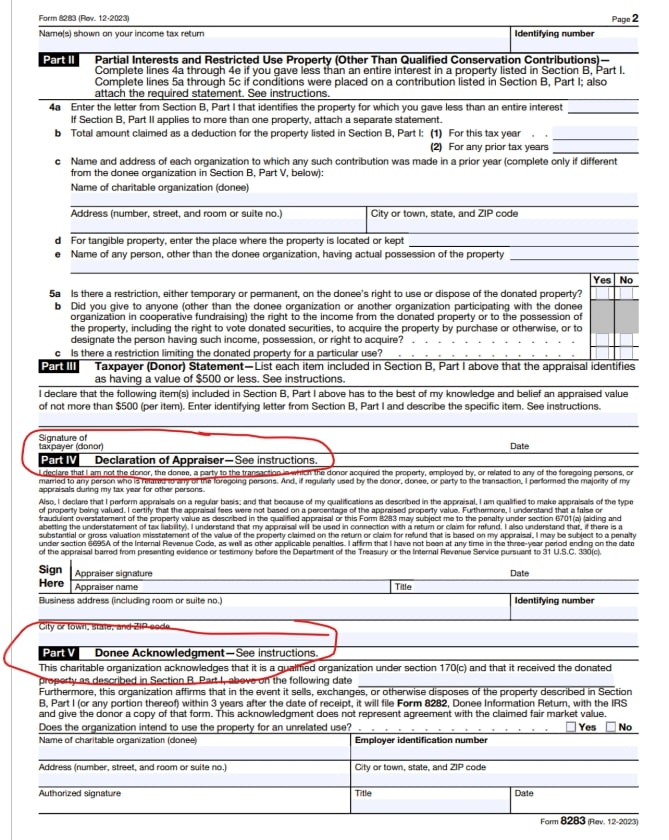

Part V: Form 8283 Requirements

Form 8283 (Noncash Charitable Contributions) is one of the few forms connected to the 1040 and 1120 that brings in the attestation of two independent parties: the appraiser and the nonprofit. IRS Counsel has repeatedly emphasized the role of both parties in their designated areas for completion—and the portions they should NOT complete.

Who Completes Which Sections

- Part I, II, and III: Completed by the TAXPAYER and their CPA only

- Part IV (Declaration of Appraiser): Completed by the APPRAISER only

- Part V (Donee Acknowledgement): Completed by the NONPROFIT only

CRITICAL: Filling out other sections of the form by either the appraiser or the nonprofit adds unnecessary significant risks and liability. Form 8283 falls under strict compliance under §155 of the Deficit Reduction Act of 1984 (DEFRA), and missing a single entry on the form is grounds for disallowance of the deduction.

Critical Elements of Part V (Nonprofit Section)

The nonprofit must complete the top portion of Part V including:

- Date of donation — Must be documented

- Related use checkbox — The nonprofit must indicate whether the donation is for a related or unrelated use. Checking one of the boxes is critical.

If a nonprofit does not plan on using the donation for a “Related Use” aligning with their nonprofit mission as documented in the 1023 501(c)(3) application, the donation could be disallowed. Additionally, if the nonprofit sells the property within three years without establishing related use, Form 8282 triggers a claw-back of the delta between the appraised Fair Market Value and the nonprofit’s sales price.

Form 8282 Claw-Back Rule

If the nonprofit sells donated property within three years, and the sale price is less than the appraised value, the taxpayer’s deduction may be reduced retroactively. There are two exceptions:

- If the item had an appraised value of less than $500

- If the items were used to fulfill the exempt purpose of the tax-exempt organization

Appraiser’s EIN or SSN

Each signatory to an appraisal must provide their EIN if they own the appraisal company or must provide their SSN if they are an employee of the appraisal company. To avoid sharing personal SSN information, appraisers can apply for an EIN online through IRS.gov as a sole proprietor or become an LLC or other pass-through entity.

Part VI: Landmark Cases and Legal Precedents

Several Tax Court cases have established important precedent for deconstruction appraisals. Understanding these cases is essential for both appraisers and taxpayers.

Mann v. United States (2019, Affirmed on Appeal 2021)

This landmark case established crucial precedent in determining how deconstructed and donated building materials should be valued. The federal court of appeals affirmed the district court’s rejection of the taxpayer’s claimed deduction.

Key Issues Identified:

- The appraiser used the Cost Approach claiming there was not a resale market—which is false

- The appraiser used RS Means construction cost estimating software with arbitrary depreciation

- The appraisal included values for foundation and drywall that were never donated

- The appraisal valued the entire house assuming every component would be severed and donated

The Court’s Ruling: The court stated that a “proper way” to value such donations is “based on the resale value of the specific building materials and contents” that were actually removed and donated. The appraisal never provided the IRS with an estimate of the value of those materials.

Loube v. Commissioner (2020)

In this case, the taxpayer lost their deduction primarily because Form 8283 was not filled out completely and signed by all required parties. The same appraiser and nonprofit involved in Mann were involved in this case.

Key Takeaway:

Form 8283 compliance is not optional. Missing a single entry can result in complete disallowance of the deduction. The form must be completed in its entirety by all parties.

Chirelli v. Commissioner (2021)

Another case where the taxpayer lost their non-cash charitable contribution due to lack of substantial compliance in producing an IRS Qualified Appraisal.

Key Issues:

- Form 8283 was not filled out completely and signed by all required parties

- The appraisal grouped items into general categories without specifically describing them

- Condition was noted as a general “excellent” without specific detail

- The Contemporaneous Written Acknowledgement and accompanying substantiation were found lacking

Part VII: Best Practices for Appraisal Production

Documentation Requirements

Every appraisal should include:

- Detailed descriptions of each item being appraised, with cross-referencing to photographs

- Condition reports that go beyond vague terms like “good” or “excellent”—providing specific, objective details

- High-quality photographs of each item (the IRS’s #1 complaint is poor-quality photographs)

- Comparable sales data with analysis explaining how each comparable relates to the subject property

- Correct dates (effective date, valuation date, and report date)

- Number of items and pages in the appraisal with cumulative totals

- USPAP certification and compliance statement

Comparable Sales Best Practices

- Use varied sources—avoid relying solely on one database

- Provide descriptions, photos, sale prices, and relevant details for each comparable

- Do not let comparables “speak for themselves”—explain how each relates to the subject

- Include multiple comparables for each item to avoid cherry-picking only the highest prices

- Apply statistical analysis (mean, median, mode, range) to comparable data

- The IRS prefers three solid comparables, ideally within a three-year period

What NOT to Include

- Asking prices as the primary basis for valuation (they are aspirational)

- Superfluous glossary terms unrelated to the assignment

- Unrelated extensive quotes or market narratives

- “Laundry list” comparables with no support or narrative

- Items that were never actually donated to the nonprofit

Timing Requirements

The appraisal must be prepared, signed, and dated no earlier than 60 days before the date of the contribution and no later than the due date (including extensions) of the return on which the deduction is claimed.

Part VIII: How to Evaluate an Appraiser

Choosing the wrong appraiser can compromise not just the tax deduction but trigger underpayment fines and penalties. Here is a comprehensive checklist for evaluating potential appraisers.

Education and Credentials Verification

- Verify college education — Does the signatory appraiser have an undergraduate or master’s degree in a field complementary to valuation methodology (economics, finance, accounting, statistics, construction management, engineering, architecture)?

- Confirm accreditation — Is the appraiser an accredited member of ASA, AAA, or ISA? Search each organization’s directory. Ensure they were not “grandfathered” in prior to heightened educational requirements.

- Check for Circular 230 violations — Has the appraiser been precluded from IRS practice? A criminal background check can identify potential issues.

Red Flags to Avoid

- Claims of being “audit-proof” — No appraiser can guarantee this. The taxpayer gets audited, not the appraiser.

- Refuses to share appraisal with your CPA — Every appraiser should be proud to show their work.

- Uses RS Means or Marshall & Swift software — This is the Cost Approach shortcut that has led to disallowed deductions.

- Produces one-page appraisals for full-house deconstructions — Proper appraisals require extensive documentation.

- Claims E&O insurance protects the taxpayer — E&O insurance protects the appraiser, not the donor. The IRS does not ask for proof of insurance.

The “Experience” Myth

Some appraisers claim decades of experience as proof of qualification. However, consistency of wrong practices for a long duration does not prove correct application of methodology. Many years of producing appraisals using incorrect valuation methods does not a competent appraiser make.

When an appraiser claims they have “never had a single audit,” remember: the taxpayer is notified of an audit, not the appraiser. Taxpayers often accept disallowance without notifying the appraiser.

Part IX: The Appraisal Process

Understanding the proper workflow for a deconstruction appraisal ensures that all parties fulfill their responsibilities and the deduction is properly substantiated.

Step-by-Step Process

- Initial Contact and Scope Determination: The client contacts the appraiser to discuss the potential donation. The appraiser reviews preliminary information, documents, photographs, and may conduct an in-person inspection of the property.

- Preliminary Value Range (No Cost): The appraiser provides an estimated value range based on line-item valuation datapoints—not simple square-footage calculations. This detailed list is sent to the nonprofit and/or deconstruction contractor to confirm each item will be donated.

- Fee Quote and Engagement: A fee is quoted for appraisal services. The client decides whether to proceed with deconstruction based on the preliminary value range and cost analysis.

- Deconstruction and Donation: The deconstruction contractor carefully dismantles the structure. Materials are donated to the nonprofit recipient organization.

- Contemporaneous Written Acknowledgement (CWA): The nonprofit provides a dated receipt with detailed inventory of all materials accepted. This is critical—appraisers must only appraise what has actually been donated.

- Appraisal Research and Production: Research begins only after receiving complete documentation from the nonprofit. For each item: detailed description, condition assessment, comparable sales research, statistical analysis, and valuation conclusion.

- Report Delivery: The complete appraisal report is delivered to the client, along with completed Part IV of Form 8283.

- Form 8283 Completion: The taxpayer and CPA complete Parts I, II, and III. The nonprofit completes Part V. All parties sign as required.

Time Investment

Producing a proper deconstruction appraisal of a residential structure typically requires 80-90 hours of office time for research and reporting. This includes researching 150+ components with multiple comparable sales for each, applying statistical analysis, documenting conditions, and producing a comprehensive report.

Appraisals produced using software shortcuts in 30-60 minutes are not properly substantiated and put the taxpayer at significant risk.

Part X: Tax Implications and AGI Limitations

Deduction Limitations for Personal Property

The amount you can deduct for donated personal property depends on how the charity uses the item and your Adjusted Gross Income (AGI):

- Related Use: If the property is related to the charity’s exempt purpose, you can deduct Fair Market Value. Contributions of appreciated capital gain property to public charities are limited to 30% of AGI.

- Unrelated Use: If the charity uses the property for an unrelated purpose, the deduction is limited to the lesser of FMV or your cost basis.

Carryforward Rules

If your charitable contribution deduction exceeds the AGI limitations, you can carry forward the unused portion for up to five years (IRC §170(d)(1)). The excess is subject to the same percentage limitations in subsequent years.

Similar Types of Property Grouping

The IRS has a grouping requirement where any group of similar property exceeding an aggregate value of $5,000 requires an appraisal. For example, if a donor donates three sets of furniture in January, March, and September with values of $2,000 each, the aggregate value is $6,000 and would require an appraisal for ALL furniture donated throughout the year.

Similar items of property are defined in 26 CFR 1.170A-13(c)(7)(iii) and include: furniture, jewelry, clothing, books, ceramics, sculpture, land, buildings, and other defined categories.

Multiple Form 8283s

You may need multiple Form 8283s for: separate recipient charities, donations made on different dates throughout the year, or different categories of property.

About the Author

CPA, ISA AM President & CEO The Green Mission Inc. | GM-ESG | Probity Appraisal Group | MAS LLC

Jessica I. Marschall, CPA, ISA AM is a certified public accountant with 26 years of experience and an IRS Qualified Appraiser specializing in personal property and deconstruction appraisals. She serves as President and CEO of four companies: The Green Mission Inc., a nationally recognized deconstruction appraisal firm; GM-ESG, providing corporate decommissioning services with ESG reporting and valuation consulting; Probity Appraisal Group, specializing in art, antiques, collectibles, and intangible asset valuations; and MAS LLC, a tax advisory firm.

Since founding The Green Mission Inc. in 2019, Jessica has built the firm into an industry leader, currently serving approximately 1,000 clients annually for deconstruction donations nationwide. Her unique combination of deep tax expertise and personal property appraisal credentials allows her to bridge the gap between IRS compliance requirements and sustainable building practices.

Jessica holds an Accredited Member (AM) designation from the International Society of Appraisers and has completed comprehensive personal property education through the American Society of Appraisers, International Society of Appraisers, and the Appraisers Association of America’s CASP training program. She has accumulated over 400 hours of continuing education in appraisal methodology, tax law, and valuation practices.

A prolific educator and author, Jessica has written over 150 articles on tax, valuation, and non-cash charitable contribution subjects. She regularly presents webinars and seminars on advanced tax topics including Opportunity Zones, Section 351 asset transfers, and charitable contribution substantiation requirements. She has presented on deconstruction appraisals at various conferences.

Jessica is qualified to teach and regularly delivers CPE credit courses in advanced tax and appraisal subjects. She serves as a Board Member and Treasurer of the Stafford Educational Foundation and has been a Board Member with Rethos’s for three years, furthering her commitment to sustainable practices and community development.

Through her work with The Green Mission Inc. and GM-ESG, Jessica partners with builders, developers, demolition contractors, deconstruction contractors, and nonprofit organizations across the country to ensure that tax deductions for deconstructed materials are accurately documented, properly valued, and fully compliant with IRS requirements—protecting both taxpayers and the integrity of the sustainable building movement.

Appendix: Key IRS References and Resources

Part I: Foundations of Deconstruction Appraisals

- IRC §170 — Charitable Contributions

- IRC §170(f)(11)(E) — Qualified Appraiser Definition

- Treasury Regulation §1.170A-17 — Qualified Appraisal Requirements

- Treasury Regulation §1.170A-13(c)(7)(iii) — Similar Property Grouping

- 26 CFR 1.170A-13 — Recordkeeping and Return Requirements

- Circular 230 — Rules Governing Practice Before the IRS

IRS Publications

- Publication 526 — Charitable Contributions

- Publication 561 — Determining the Value of Donated Property

- Form 8283 — Noncash Charitable Contributions

- Form 8283 Instructions

- Form 8282 — Donee Information Return

Professional Appraisal Organizations

- American Society of Appraisers (ASA) — www.appraisers.org

- Appraisers Association of America (AAA) — www.appraisersassociation.org

- International Society of Appraisers (ISA) — www.isa-appraisers.org

- The Appraisal Foundation — www.appraisalfoundation.org

Key Court Cases

- Mann v. United States, January 2019 (District Court), Affirmed January 2021 (Appeals)

- Loube v. Commissioner, T.C. Memo 2020

- Chirelli v. Commissioner, T.C. Memo 2021-027

- O’Connor v. Commissioner, 2001 (Condition Report Standards)

- Gifford M. Mast, Jr. v. Commissioner (Market Data Approach)

The Green Mission Inc.

Expert Deconstruction Appraisals & IRS Qualified Services

www.thegreenmissioninc.com

(540) 322-3884 | Info@TheGreenMissionInc.com

375 White Oak Road, Falmouth, VA

© 2025 The Green Mission Inc. All Rights Reserved.