During my recent meetings in Chicago for both MAS LLC, my tax consultancy, and The Green Mission Inc., our sustainability and valuation firm, I was reminded why the city and the broader Upper Midwest remain national leaders in the deconstruction and reuse movement. From forward- thinking policy to grassroots innovation, this region fosters one of the most engaged and thoughtful circular economies in the country. The partnerships I have developed here over the years continue to inspire me, as do the organizations and individuals leading this work.

At The Green Mission Inc., we specialize in the valuation of architectural elements salvaged from historically significant commercial and residential properties across the United States. These include entire limestone and terracotta facades, carved friezes, monumental cornices, and ornate window surrounds—as well as interiors composed of antique hardwood millwork, decorative lighting, reclaimed wood flooring, and vintage plumbing fixtures.

The construction industry is undergoing a fundamental transformation—one driven not only by climate urgency but by market logic. According to McKinsey & Company’s recent article, “How Circularity Can Make the Built Environment More Sustainable,” the adoption of circular practices in construction could reduce up to 75 percent of embodied carbon emissions by 2050 and create as much as $360 billion in net value gains across key building materials. These gains are not speculative—they are grounded in realistic shifts in material sourcing, reuse, and system redesign.

When you make a non-cash charitable donation over $5,000—whether it is reclaimed building materials, artwork, or furniture—you are required by the IRS to obtain a Qualified Appraisal from an IRS Qualified Appraiser. Hiring the wrong appraiser will not just impact your deduction—it could void it entirely and trigger penalties.

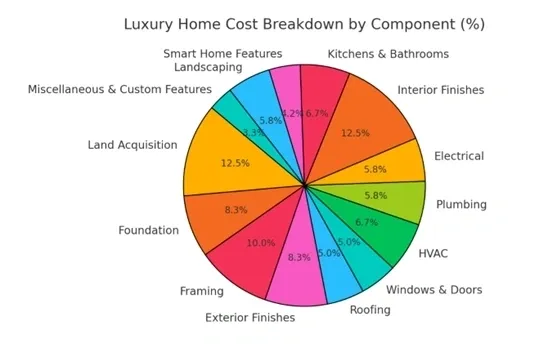

For over two decades, advocates of “deconstruction” and material reuse have touted the environmental and economic benefits of salvaging building components. Yet the secondary market for used building materials and furnishings has remained stubbornly underdeveloped, with low demand and low value relative to new goods. Today, however, a new factor is emerging that could tip the scales: escalating U.S. tariffs on a wide range of imported goods. As trade barriers drive up the cost of new building materials, appliances, and household items, the enormous price gap between new and used goods presents a timely opportunity to finally make reuse mainstream. But seizing this moment will require overcoming long-standing supply chain challenges through unprecedented coordination between nonprofits and for-profit firms.

In addition to our core Appraisal services, our team provides expertise in calculating an estimate of the original IRS Defined Cost Basis, which is a crucial aspect required for IRS Form 8283 Part 1 Section 3, box (f).

The choice of lumber used in residential home construction in the United States is heavily influenced by regional forest resources, climate conditions, and supply chain logistics. While most homes utilize standard dimensional lumber, the species and grades vary considerably based on location. This article outlines the most commonly used framing lumber types across major U.S. regions.

When making charitable contributions, taxpayers often consider donating either appreciated real estate or personal property. While both can yield significant tax benefits, the IRS applies different rules regarding deductibility, Adjusted Gross Income (AGI) limitations, and carryforward provisions. Understanding these distinctions can help donors maximize their tax benefits.

The valuation of materials and fixtures within real estate depends heavily on their attachment to the property versus their status as detached personal property. This principle is crucial in real estate appraisals, taxation, insurance, and donation valuations, particularly in the context of deconstruction and salvage. When components remain attached as part of an improvement, they typically carry higher value due to their contribution to the real estate’s utility, marketability, and financing potential. However, once removed, their value often declines due to depreciation, secondary market limitations, and diminished functionality in a different setting.

The Internal Revenue Code (IRC) Section 170 provides valuable tax incentives for C Corporations to donate inventory to qualified charitable organizations. Specifically, Section 170(e)(3) allows an enhanced charitable deduction for inventory donations, a provision designed to encourage businesses to contribute surplus goods to nonprofits rather than discarding them or selling them at a loss. Below, we explore the details of this provision, including how the deduction is calculated, substantiation requirements, and when an appraisal is necessary.