The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduces significant changes to charitable contribution deductions that will directly impact donors of deconstructed building materials, household furnishings, and other tangible personal property beginning January 1, 2026.

After decades in federal tax policy and years in deconstruction, I’ve learned the vast tax code holds powerful solutions. Today, those tools are urgently needed to address critical challenges we all face.

The three parties to an appraisal MUST remain independent to ensure accuracy and validity of the deconstruction tax donation. We recently experienced an issue where these lines were blurred, and the taxpayer could have found themselves without a compliant appraisal.

The US Tax Court has delivered yet another loss of a non-cash charitable contribution, this time due to a technicality. In the latest case, Albrecht v. Commissioner, TC Memo 2022-531, a well-meaning donor lost the value of her entire charitable deduction for property donated to a museum due to a technicality in the written receipt provided by the museum.

It appears to be typical of any IRS codification or procedural direction, that the end result must be confusion. Obtaining clarification may involve hours of wait-time to speak to a real person or a head-first dive down the rabbit hole of reading scholarly articles on a CPA or tax attorney’s interpretation of said codification. When it comes to appraisers, they may inadvertently interpret IRS publications incorrectly and expose the client to risk for an audit and the subsequent loss of their non-monetary charitable contribution deduction due to failure to procure proper documentation.

The concept of “Related Use” continues to present an area of confusion, especially for nonprofits and relates directly to Tax Form 8282. Related-use is the stipulation that a nonprofit must utilize donations to further their defined mission.

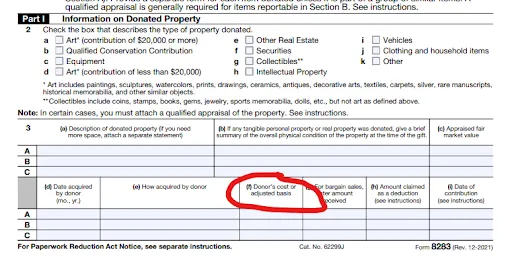

For non-cash charitable contributions exceeding $5,000, the IRS requires completion of Form 8283 Section B by the taxpayer and certification by a qualified appraiser. Box F of this section specifically requires the donor to provide the original cost or adjusted basis of the donated property. This entry allows the IRS to evaluate whether the claimed charitable deduction is reasonable in comparison to the donor’s original investment.

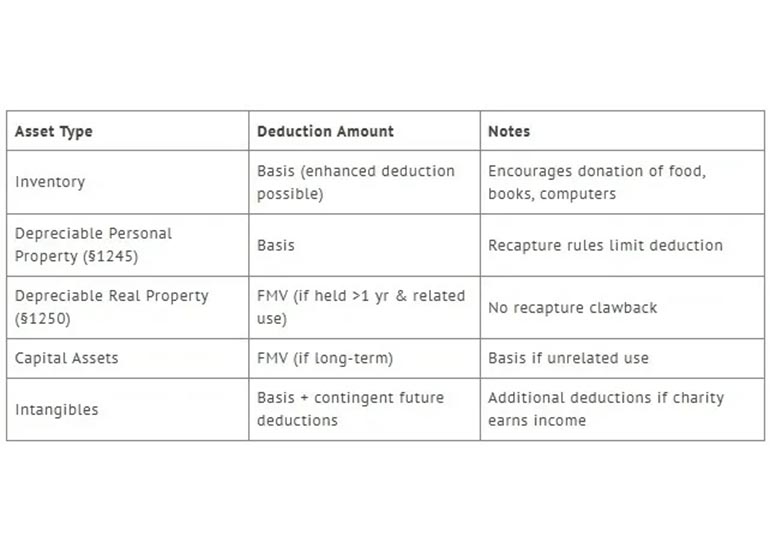

For corporations, donating property to charity can be more than an act of goodwill, it can also generate meaningful tax savings. Yet not all property is treated the same under the Internal Revenue Code. Some assets qualify for a deduction at their full fair market value (FMV), while others are limited to the company’s basis. Knowing these rules is critical for tax planning, compliance, and maximizing the benefit of charitable giving.

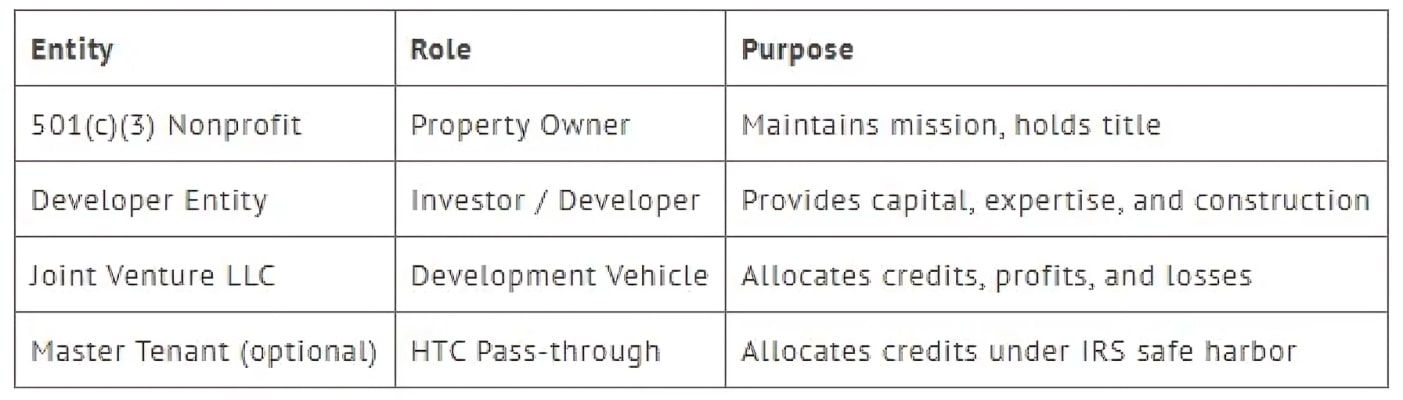

The Federal Historic Tax Credit (HTC) remains at 20 percent, applied to the eligible rehabilitation costs of income-producing historic properties. This incentive is critical for the rehabilitation of income-generating portions of qualified properties such as historic theaters.

The One Big Beautiful Bill (OBBB), passed in 2025, includes several sweeping changes to the U.S. tax code, many of which directly impact charitable giving strategies, particularly for taxpayers who itemize deductions. One of the most consequential changes is the introduction of a 0.5% adjusted gross income (AGI) floor on non-cash charitable contributions, which restricts the deductibility of lower-value in-kind gifts. However, an equally important and often overlooked change is the reinstatement of a cap on total itemized deductions, a provision that mirrors the spirit and structure of the former Pease limitation.