When property owners choose deconstruction over demolition, they unlock powerful tax benefits through charitable contributions that can offset, or sometimes even exceed, additional project costs. Yet the pathway from salvaged materials to legitimate tax deductions is fraught with technical requirements that, if overlooked, trigger complete disallowance of these benefits. The IRS has transformed noncash charitable contributions into an enforcement priority, wielding strict procedural standards as their primary weapon against perceived abuse.

The Green Mission Inc. has strengthened its deconstruction appraisal protocol, responding to recent tax-deduction cases by enhancing IRS- and USPAP-compliant documentation, valuation support, and more rigorous standards for developing preliminary estimated value ranges.

The latest climate report from the Intergovernmental Panel on Climate Change (IPCC), states that “Global warming is dangerously close to spiraling out of control” and humans are “unequivocally” to blame.

On November 7th, 2024, the Appraisers Association of America (AAA) hosted an enlightening panel featuring Susan Hunter (moderator), Karin Gross (IRS Counsel), and Meredith Meuwley, AAS (Art Advisory Services). The panel discussed critical updates and best practices for appraisers preparing reports for gift, estate, and non-cash charitable contributions, highlighting the importance of professionalism, due diligence, and adherence to IRS guidelines. Below is a detailed summary and analysis of the discussion, crafted for CPAs, personal property appraisers, and most importantly, the taxpayer.

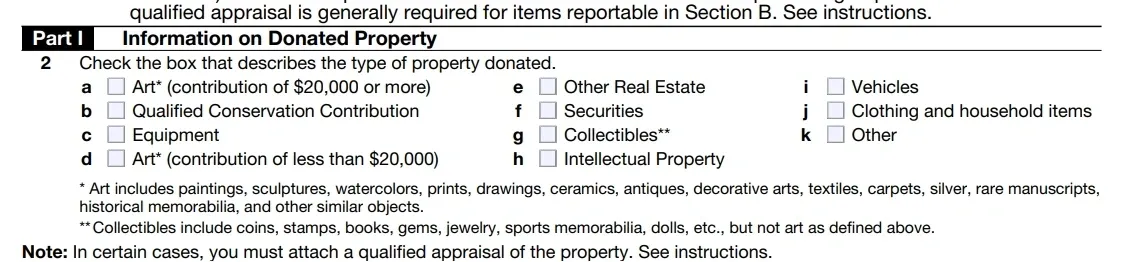

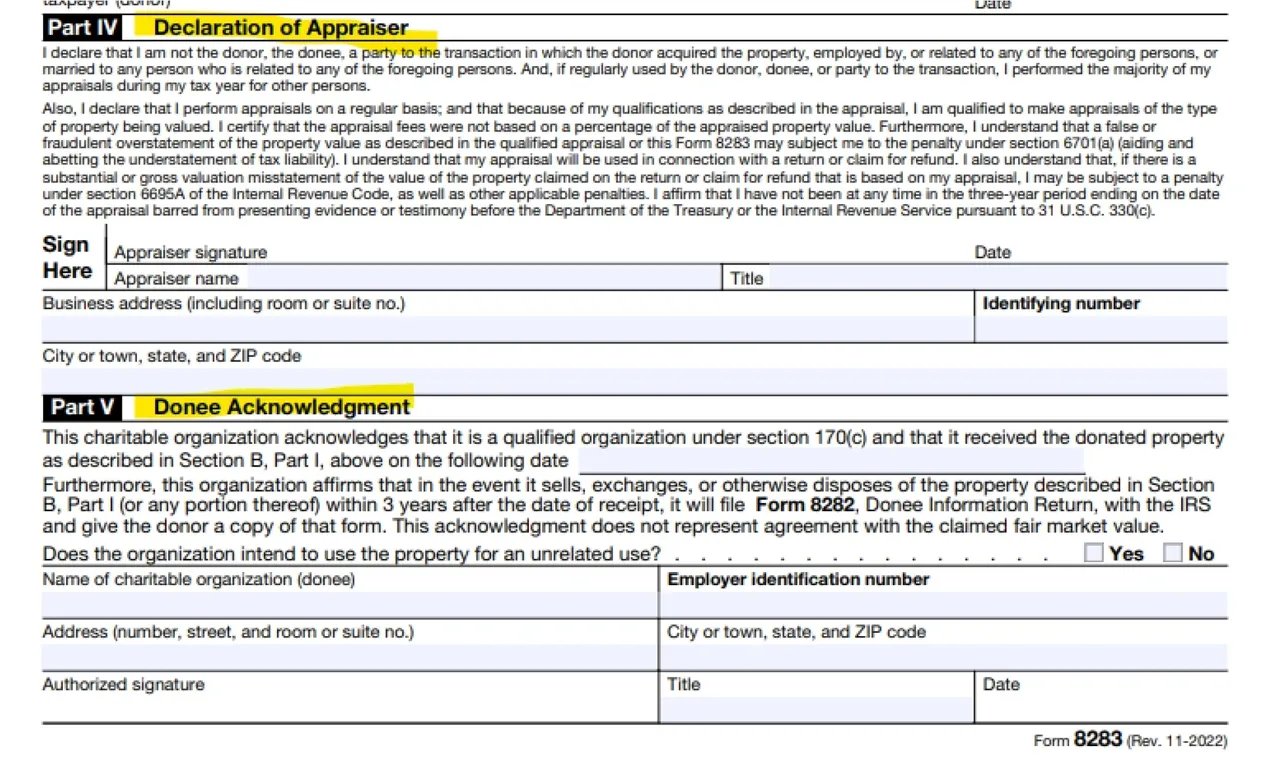

When you make a non-cash charitable donation over $5,000—whether it is reclaimed building materials, artwork, or furniture—you are required by the IRS to obtain a Qualified Appraisal from an IRS Qualified Appraiser. Hiring the wrong appraiser will not just impact your deduction—it could void it entirely and trigger penalties.

In addition to our core Appraisal services, our team provides expertise in calculating an estimate of the original IRS Defined Cost Basis, which is a crucial aspect required for IRS Form 8283 Part 1 Section 3, box (f).

When making charitable contributions, taxpayers often consider donating either appreciated real estate or personal property. While both can yield significant tax benefits, the IRS applies different rules regarding deductibility, Adjusted Gross Income (AGI) limitations, and carryforward provisions. Understanding these distinctions can help donors maximize their tax benefits.

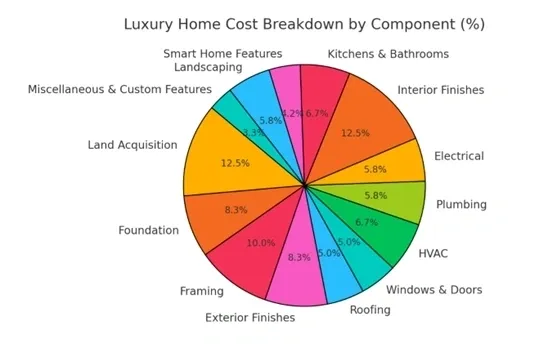

The valuation of materials and fixtures within real estate depends heavily on their attachment to the property versus their status as detached personal property. This principle is crucial in real estate appraisals, taxation, insurance, and donation valuations, particularly in the context of deconstruction and salvage. When components remain attached as part of an improvement, they typically carry higher value due to their contribution to the real estate’s utility, marketability, and financing potential. However, once removed, their value often declines due to depreciation, secondary market limitations, and diminished functionality in a different setting.

Our CEO Jessica I. Marschall, CPA, ISA AM recently attended the Appraisers Association of America annual conference in Manhattan.

IRS Counsel and presenters included Karin Gross, Meredith Meuwly, and Cynthia Herbert and provided critical feedback on the appraisal process.

The Green Mission Inc. has strengthened its deconstruction appraisal protocol, responding to recent tax-deduction cases by enhancing IRS- and USPAP-compliant documentation, valuation support, and more rigorous standards for developing preliminary estimated value ranges.